The Jobs Market Has Turned

The latest ONS data show Britain’s labour market weakening fast.

Unemployment has risen to 5% — the highest since the Covid lockdowns — while payroll jobs continue to fall.

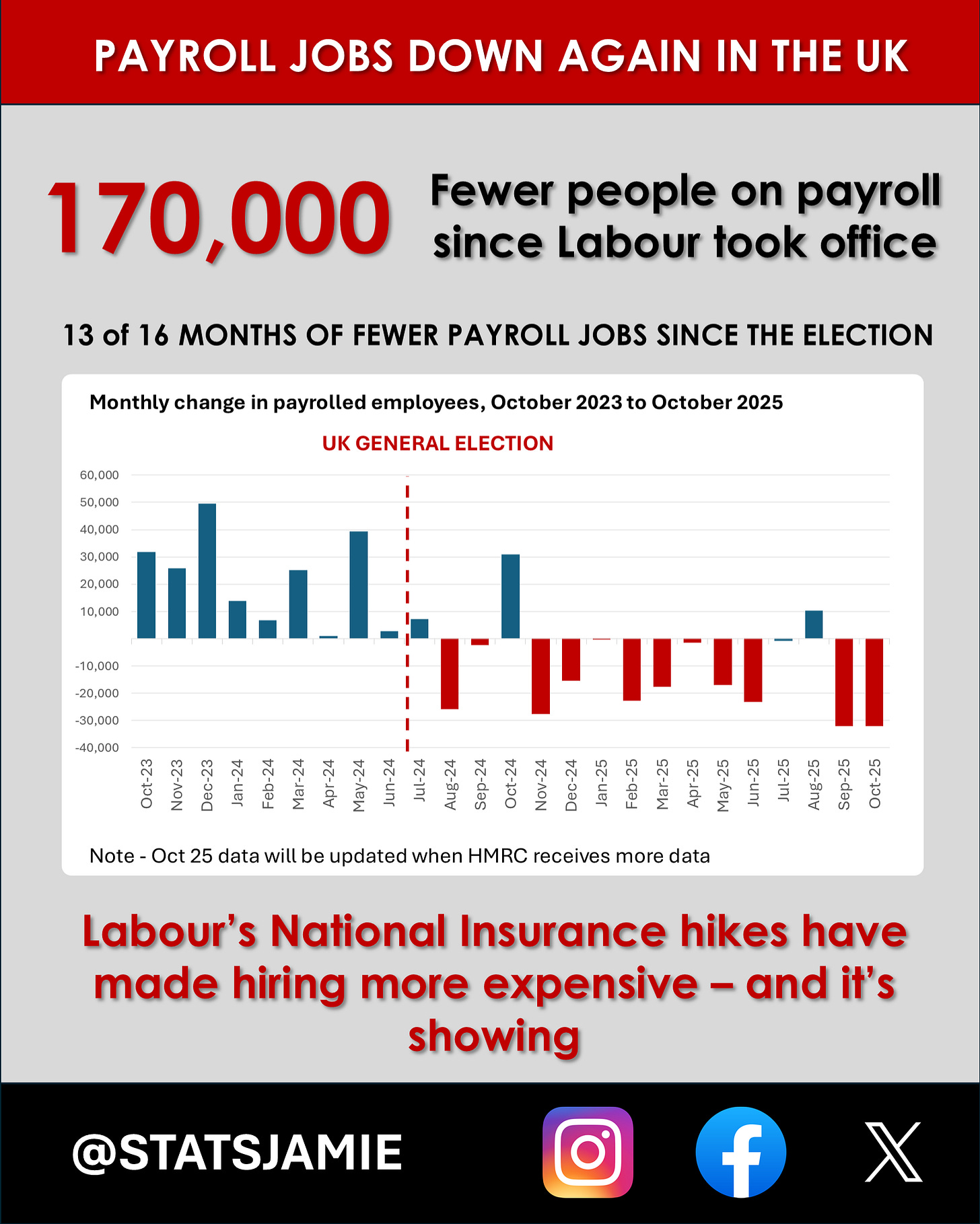

Since Labour took office, around 170,000 people have come off the payroll, and the decline is accelerating — 64,000 lost in just the past two months.

Before the election, payrolls were rising. Since then, as the chart below shows, the trend has flipped — 13 monthly declines in 16 months.

That’s not a blip. It’s a slide.

Younger Workers Are Bearing the Brunt

The damage isn’t evenly spread.

220,000 losses have been among people under 35.

London and Wales have seen the steepest percentage declines in employment.

Even Westminster itself — where decisions are made — has recorded the biggest proportional job losses in the UK.

Retail and hospitality are being hit hardest — sectors not threatened by AI, but by policy.

Labour’s so-called “jobs tax” has made it more expensive to hire and keep staff, forcing employers to cut back shifts and roles.

Public vs Private: Two Speeds, One Weak Economy

Britain’s pay growth has split into two.

Across the private sector, total pay rose 4.4% in the three months to September 2025, compared with the same period a year earlier — showing how wage momentum is now fading fast.

Meanwhile, public sector pay (excluding financial services) jumped 7.3% over the same period, driven by one-off settlements and back-dated deals in health and education.

It’s another sign of imbalance: the state-funded workforce is still seeing strong pay rises while the productive private sector stalls. That’s not sustainable growth — it’s redistribution funded by borrowing.

The Borrowing Black Hole — A Quick Reminder

We covered this in detail last week, but it’s worth a quick reminder: the OBR forecast £102.6 billion in borrowing from August 2024 to September 2025. The actual figure is £194.4 billion — a staggering £92 billion more under Labour than expected.

When fewer people are in work, more money has to be used by the state to support them, and there’s less money circulating through the economy. That in turn costs more jobs, creating a downward spiral that Labour’s “jobs tax” is only making worse.

🔗 Read the full breakdown here: Rachel Reeves Has Dug a £92 Billion Hole in the Public Finances

No Wiggle Room Left

With the Budget due on November 25th, Rachel Reeves has almost no fiscal headroom left. Every new job fall means weaker revenues, higher spending, and less room to manoeuvre.

As I told Martin Daubney:

“When you’ve got 170,000 fewer people on payroll, that’s less tax coming in and more money going out. Putting taxes up and up isn’t working — it’s making things worse.”

And really, anyone with a basic grasp of economics could have predicted this. If you increase the cost of employing people, two things will happen:

Employers hire fewer people, and

They offer lower pay deals to those who remain.

Both have now happened. Yet Rachel Reeves continues to show her true credentials — a Chancellor who clearly lacks economic credibility.

The Verdict

Thirteen months of falling payrolls. Unemployment is at its highest in four and a half years. A widening gap between public and private pay, with the productive economy stagnating while state-funded wages surge.

Labour’s “jobs tax” has backfired. It’s choking the private sector, driving up costs, and leaving fewer people in work.

If Labour were serious about fixing this, they’d start by cutting the tax on jobs, easing the burden on small businesses, and encouraging hiring instead of punishing it. They’d rein in runaway public-sector pay awards that the country can’t afford, and focus on policies that grow the private sector, not shrink it.

Britain doesn’t have a shortage of workers — it has a shortage of confidence. Until that changes, the spiral of falling payrolls, weak pay, and rising borrowing will continue.

✍️ Jamie Jenkins

Stats Jamie | Stats, Facts & Opinions

📢 Call to Action

If this helped cut through the noise, share it and subscribe free at statsjamie.co.uk — get the stats before the spin, straight to your inbox (no algorithms).

📚 If you found this useful, you might also want to read:

👉 The BBC Has Been Biased for Years — It Peaked During the Pandemic — From climate change coverage to Covid hospital data, the BBC’s reputation for impartiality has long been eroding. The Trump saga and senior resignations are only the latest signs of a broadcaster that

📲 Follow me here for more daily updates: