Reeves' "Recovery" Exposed: 4 Months Of Stagnation As Tax Increases Bite

Official data confirms the economy shrank in October, with the high street suffering its worst slump since May as budget fears hit home.

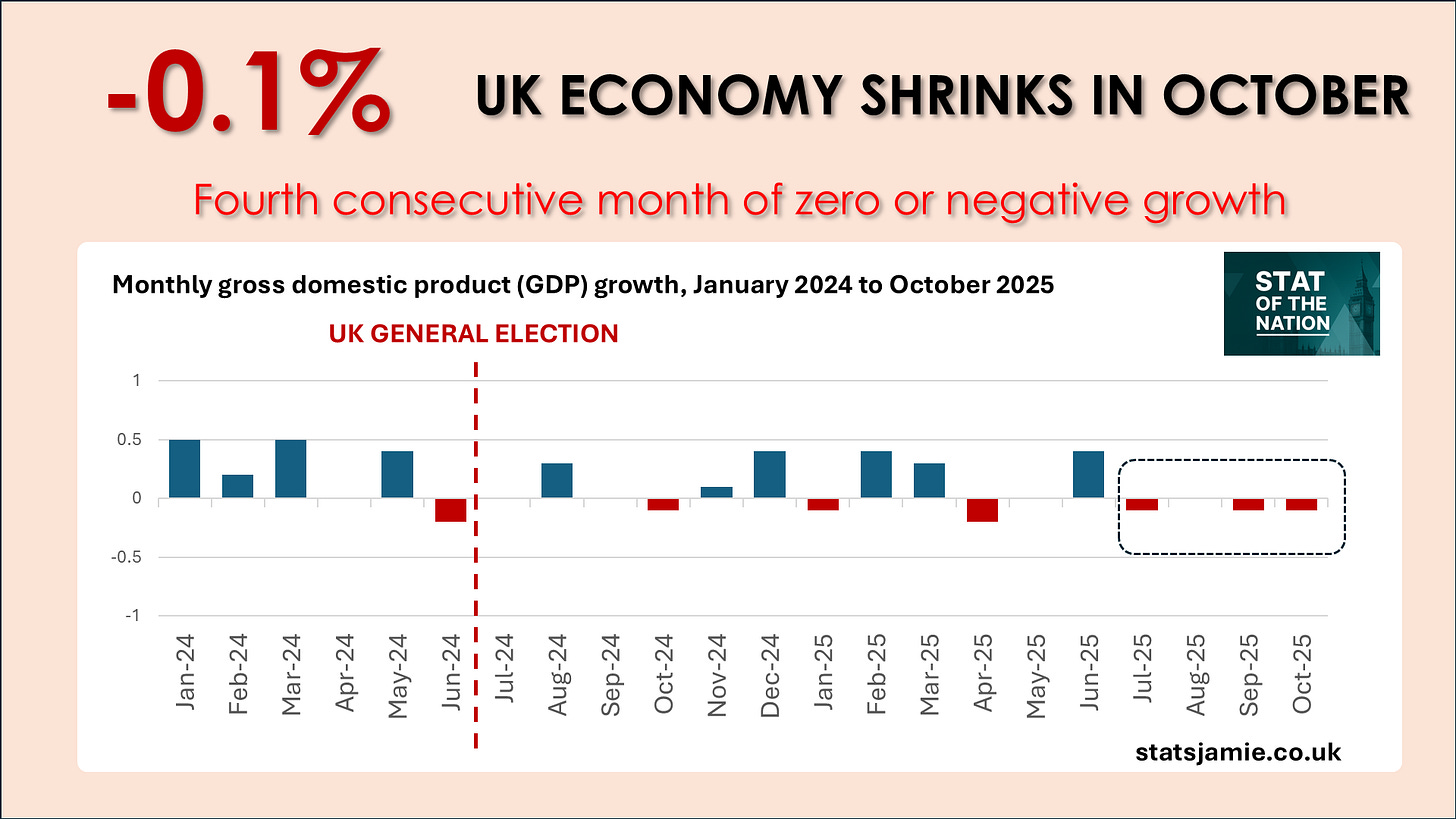

The official figures are in, and they confirm that the UK economy shrank by 0.1% in October.

Now, it is important to note that monthly GDP figures can be volatile; they often fluctuate from one month to the next. However, they provide us with a vital snapshot of what is happening right now. And looking past the month-to-month noise, the signal is undeniable: we have basically seen four months of stagnation.

This latest drop isn’t an isolated incident; it confirms a structural paralysis. The data shows four consecutive months where the economy has failed to grow. Since July, the monthly GDP trend line has been flat or falling: 📉 Oct: -0.1% 📉 Sep: -0.1% ➖ Aug: 0.0% 📉 July: -0.1%.

This is no longer just “volatility”; it is a trend of stagnation that suggests the economy has hit a hard ceiling.

📉 THE DRIVERS: HOW WE GOT TO MINUS 0.1%

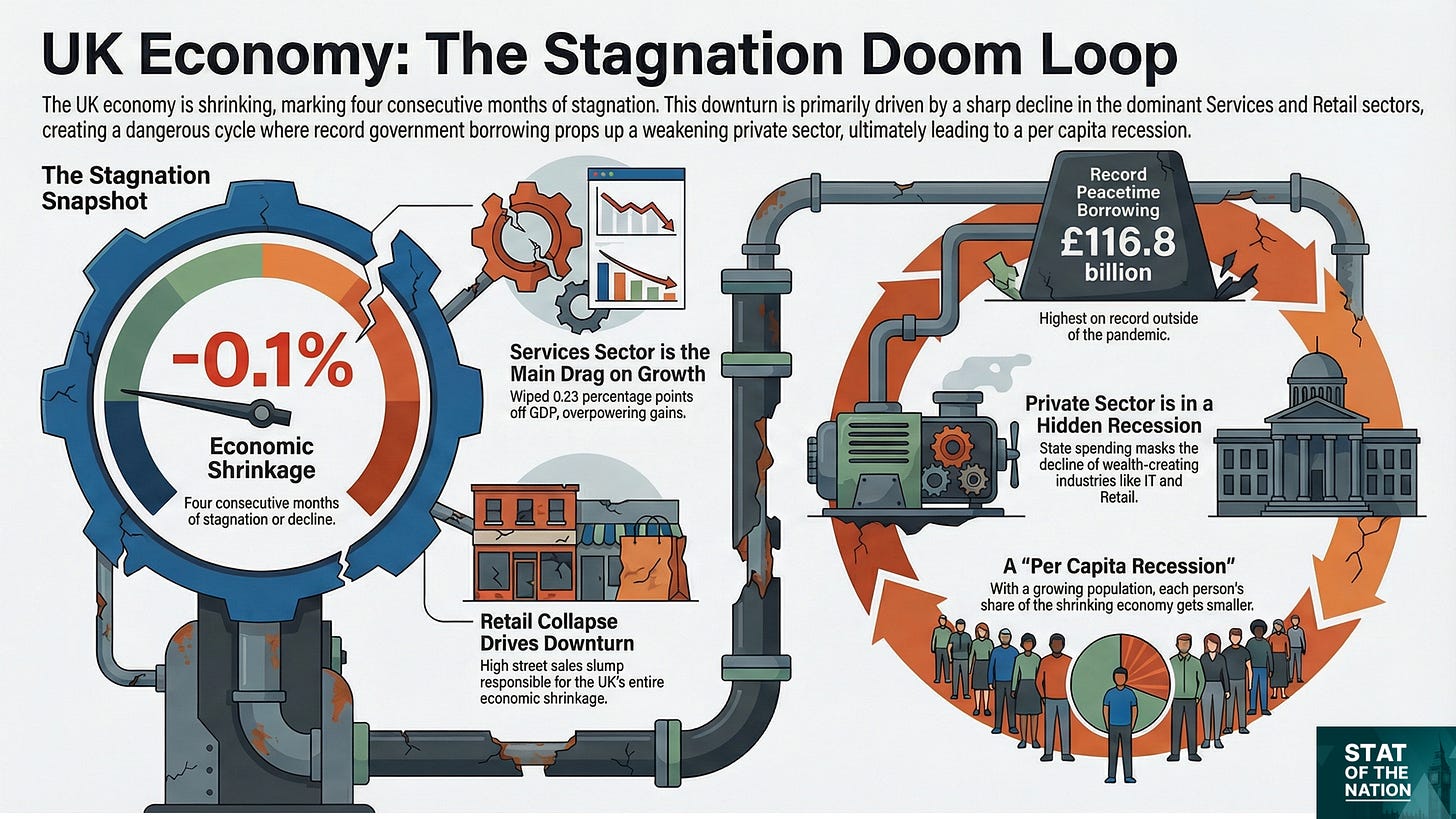

The official contraction of 0.1% (specifically -0.12%) wasn’t a simple across-the-board decline. It was the result of the UK’s dominant Service sector dragging the economy down faster than factories could prop it up.

The contribution data shows that the Services sector—the true engine of the modern British economy—wiped 0.23 percentage points off GDP in a single month. When combined with the 0.04 percentage point drag from a shrinking Construction sector, the economy was effectively bleeding growth. While Production industries added 0.14 percentage points, largely due to a slight bounce-back in car manufacturing, it simply wasn’t enough to plug the hole. The result is an economy in the red.

🛒 THE RETAIL REALITY: ONS & BRC CONFIRM THE SQUEEZE

The single biggest force dragging the economy down in October was Retail. The data is striking: this one sector alone subtracted 0.13 percentage points from GDP—meaning the decline of the high street was largely responsible for the entire shrinkage of the UK economy.

Crucially, both the ONS and the British Retail Consortium (BRC) are telling the same story about why this is happening. The BRC reported the weakest sales growth since May, explicitly blaming “Pre-Budget jitters” for destroying consumer confidence. The ONS data backs this up, revealing that sales volumes fell by 1.1%, driven significantly by a sharp contraction in Textile, Clothing, and Footwear stores.

This confirms the “Tax Trap” mechanics: items like clothing and footwear are non-essential, discretionary purchases—the very first things households cut back on when they need to find savings. Faced with the threat of tax rises and lower disposable income, families prioritised the essentials and froze spending on the nice-to-haves. This behavioural shift is a clear signal of financial caution caused by fiscal uncertainty.

💸 THE STAGNATION “DOOM LOOP”

This economic freeze creates a dangerous “doom loop” for public finances. We have now had four straight months where the economy failed to grow—but the government is still spending as if it is booming.

Government debt is measured as a share of GDP. The math is unforgiving: if the economy (GDP) stays flat or shrinks while borrowing skyrockets, the Debt-to-GDP ratio automatically worsens. And the latest borrowing figures are astronomical:

The Stat: Public sector borrowing in the financial year to October 2025 hit £116.8 billion.

The Context: This is £9.0 billion (8.4%) more than the same period last year.

The Record: If we exclude the pandemic—a unique anomaly driven by government decisions to close the economy—these are the highest April-to-October borrowing figures on record.

We are borrowing record amounts just to stand still. With the next set of borrowing figures due next week, the pressure is only building. We are driving up debt interest payments and banking up future tax rises, just to keep the lights on in a stagnant economy.

🏛️ THE PUBLIC SECTOR ILLUSION

Perhaps the most worrying trend in the data is the divide between the public and private sectors. Stripping out state spending reveals a private sector that effectively looks like it is in recession. The wealth-creating industries—Retail, IT, and Professional Services—all shrank the economy in October.

In stark contrast, the only meaningful positive contributions came from the state. Health & Social Work added 0.05 percentage points to GDP, and Public Administration added another 0.01 points. The data shows borrowing is funding an expansion of the state, while the private sector withers. This might prop up the headline GDP figure slightly, but it is a debt-fuelled mirage rather than sustainable organic growth.

Remember: without a thriving private sector, there is no public sector.

👥 THE PER CAPITA RECESSION

Finally, the data highlights a disconnect between the “economy” and “your wallet.” While headline GDP fell by 0.1%, the reality for individuals is sharper. The UK population is growing, which means the economy must grow continuously just to keep everyone’s standard of living static. With the economy shrinking and the population expanding, GDP per capita is effectively negative. The country is importing people into a shrinking economy, mathematically guaranteeing that the “slice” available to each person gets smaller.

📉 THE BOTTOM LINE: A CYCLE OF DECLINE

The data paints a clear picture of an economy in reverse. Consumer confidence is hitting rock bottom, and the impact is being felt on every high street. Retailers are seeing sales collapse, and the hospitality sector is struggling. When businesses contract, jobs are inevitably lost, leaving more families relying on the state for support.

This creates a vicious cycle. A shrinking private sector means fewer people in work and more people on benefits. That drives up the welfare bill, forcing the government to borrow even more money just to stand still. You cannot tax and borrow your way out of this trap. The only way to fix this is to get the economy moving again: cut taxes to unlock spending, encourage businesses to hire, and generate the real growth needed to pay our way.

✍️ Jamie Jenkins

Stats Jamie | Stats, Facts & Opinions

📢 Call to Action

If this helped cut through the noise, share it and subscribe for free — get the stats before the spin, straight to your inbox (no algorithms).

📚 If you found this useful, you might also want to read:

📲 Follow me here for more daily updates: