217,000 Jobs Gone: The Secret Recession They Don’t Want You to See

Private-sector jobs are collapsing, young workers are taking the hit, and taxpayers are paying twice for bad policy.

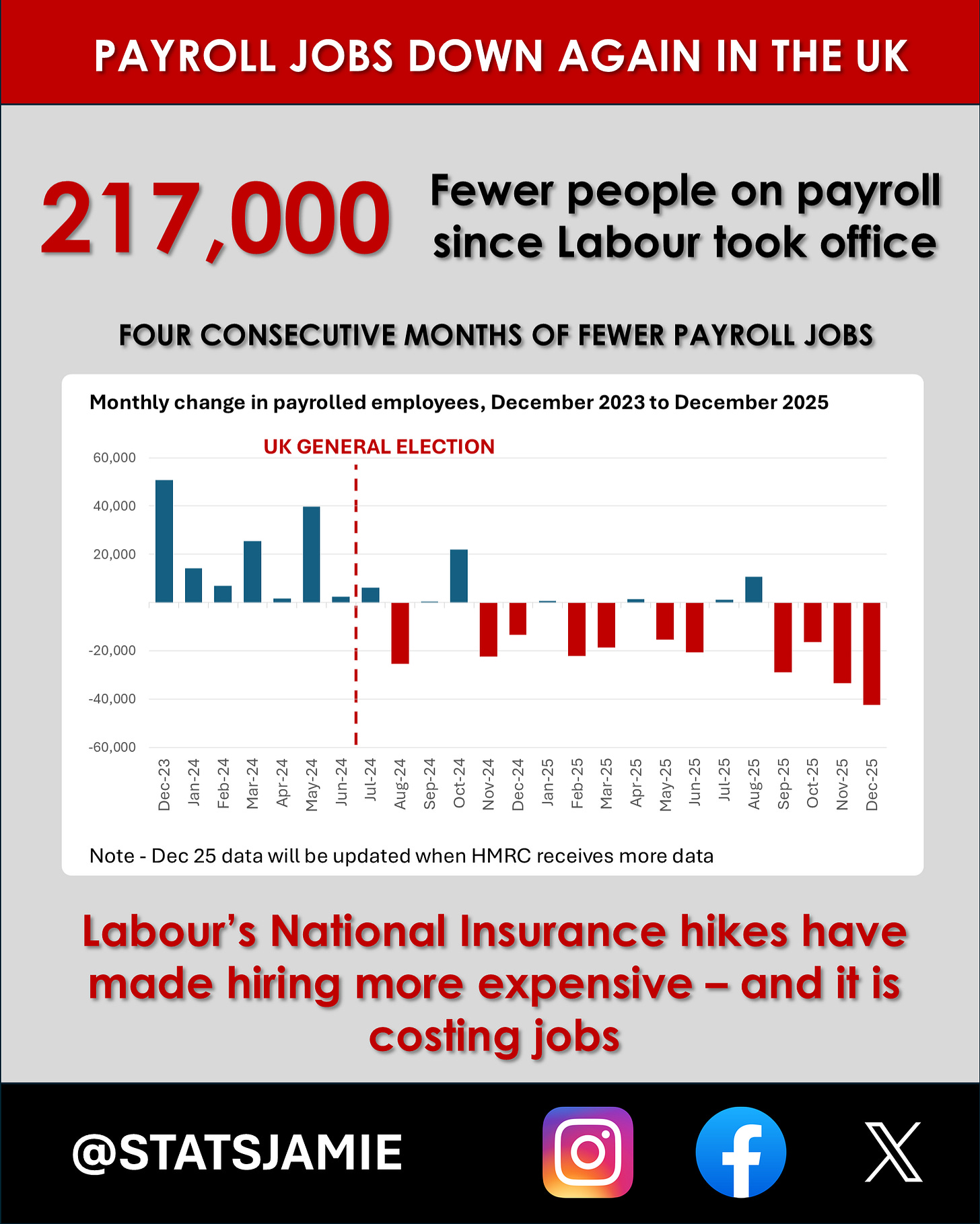

The latest PAYE Real Time Information (RTI) data — drawn from HMRC payroll records — show Britain’s jobs downturn accelerating into the end of 2025.

Since June 2024, the UK has lost around 217,000 payrolled employee jobs.

Worryingly, the pace of decline has picked up:

43,000 jobs were lost in the latest month alone

121,000 jobs have disappeared in just the last four months

These are real payroll jobs that no longer exist — not survey sentiment.

👶 A youth jobs shock

The most alarming feature of this downturn is who it is hitting.

Since the election, there are now 103,000 fewer people aged 16–24 on payrolls — meaning young people account for almost half of all job losses over the period.

Entry-level and early-career roles are always the first to go when the cost of employing people rises — and once those jobs disappear, they’re slow to return.

At the same time, older age groups are holding up better, often because people cannot afford to retire, not because the economy is thriving.

🏬 The downturn is visible on the high street

These losses aren’t abstract. They’re concentrated in sectors people see every day:

retail, hospitality, admin support, manufacturing, and information & communication.

Hospitality continues to shed jobs month after month. Retail payrolls are falling sharply. These are not roles being “automated away” — they’re labour-intensive jobs being priced out of existence.

When these jobs go:

spending falls,

footfall drops,

businesses close,

and the cycle repeats.

🏛️ The state grows while the private sector shrinks

Headline job losses understate how weak the underlying economy has become.

Since June 2024:

Public-sector-dominated industries (health, social care, public administration) have added around 80,000 payroll jobs

By contrast, the rest of the economy — overwhelmingly private sector — has lost around 300,000 jobs once that public-sector growth is stripped out

In other words, Britain is facing a private-sector jobs recession, partially masked by state expansion.

The productive economy is shrinking — while the state grows.

🧾 Warnings ignored — and the Budget made it worse

None of this should come as a surprise.

Many warned that raising the cost of employing people through Labour’s jobs tax would mean fewer hires, weaker job creation, and job losses concentrated in lower-paid, entry-level roles.

Yet instead of correcting course, Rachel Reeves doubled down.

Alongside higher employment costs, the government has leaned harder on a stealth tax on work: frozen income tax thresholds. As wages rise but tax bands stay fixed, more workers are dragged into higher rates through fiscal drag — and those freezes are now set to continue for years.

So even as jobs disappear, those still in work are taxed more heavily.

💷 From lost jobs to lost revenue

The consequences for the public finances are serious.

If around 300,000 private-sector jobs have been lost:

On average earnings, the Treasury loses roughly £3.6 billion a year in income tax and National Insurance

Even if those were minimum-wage jobs, the loss is still around £1.8 billion a year

That’s before you even consider the second-order effects: weaker consumer spending, lower VAT receipts, and slower growth.

🎓 £1.5bn to fix a problem the government created

Faced with collapsing youth employment, Labour’s flagship response is to spend £1.5 billion to create 50,000 apprenticeships.

Set against the scale of the damage already done to young workers, the inadequacy is obvious.

Even if every apprenticeship materialises, it still doesn’t come close to reversing what has already happened — and it doesn’t address the root cause: making it more expensive for employers to hire in the first place.

⚠️ The bigger picture: paying twice for bad policy

Step back, and the picture is damning.

Britain is:

losing billions in tax revenue because jobs are disappearing

spending billions more trying to patch the consequences through apprenticeships, welfare, and intervention schemes

all while shrinking the private sector that actually funds the state

This is not sound economics. It’s a feedback loop of policy failure.

Britain is paying twice:

once through lost jobs and lost tax revenue,

and again, through higher spending to clean up the damage.

That reflects serious economic incompetence at the heart of government — and it isn’t sustainable.

✍️ Jamie Jenkins

Stats Jamie | Stats, Facts & Opinions

📢 Call to Action

If this helped cut through the noise, share it and subscribe for free — get the stats before the spin, straight to your inbox (no algorithms).

📚 If you found this useful, you might also want to read:

📲 Follow me here for more daily updates:

It has been done deliberately.

Howard Lutnicks words at the WEF yesterday summed up what has happened since the 80's. Off-shoring, high immigration, expanding office work and public sector whilst reducing manufacturing. Making universities income generators and councils into corporations has also been our undoing.

Thank you for your work sharing the facts.