Reeves' Borrowing Blowout: £18bn in August, 44% Above Forecast

Debt now £2.91 trillion — equal to £52,000 per adult, with interest costs at historic highs.

📉 Borrowing Blowout in August

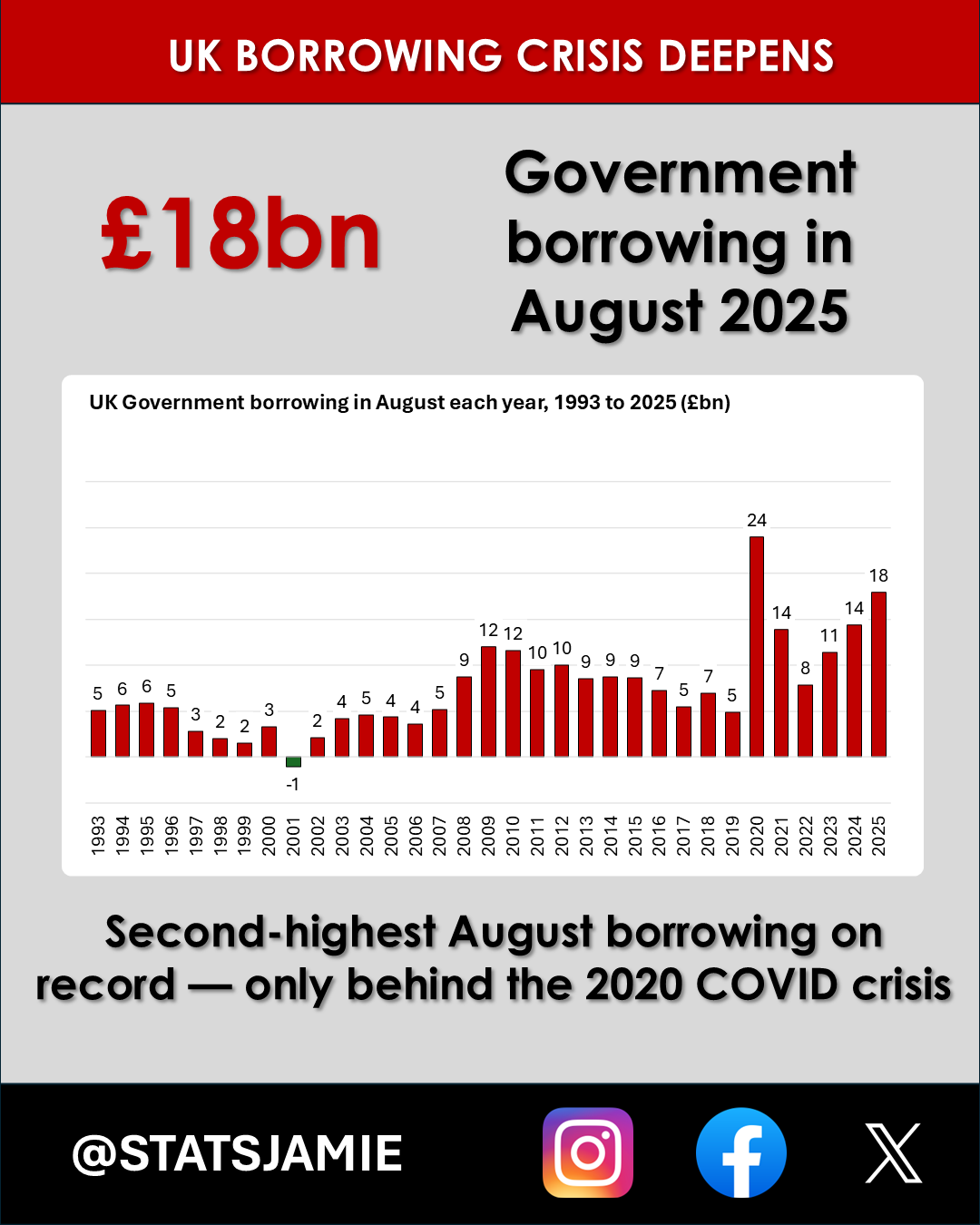

The UK Government borrowed £18.0 billion in August 2025. To put that in perspective:

It’s the second-highest August deficit on record, only surpassed during the extraordinary Covid-era borrowing of 2020.

Compared with last year, borrowing rose by £3.5 billion.

Crucially, the Office for Budget Responsibility (OBR) had forecast just £12.5 billion for August. That means actual borrowing was £5.5 billion higher, 44% above forecast.

These aren’t just small misses. They show a government that cannot get control of the public finances, and an economy delivering weaker receipts while costs spiral.

👉 After stripping out the Covid spike, 2024 and 2025 now stand as the two highest August borrowing figures in modern records (since monthly data began in 1993).

📊 Total Debt Nears £3 Trillion

The UK’s public sector net debt (excluding public sector banks) is now:

£2,909,418,000,000

That’s almost £2.91 TRILLION.

For context:

In 2007, on the eve of the financial crisis, debt was just £0.6 trillion (36% of GDP).

Today it’s 96.4% of GDP — levels not seen since the early 1960s.

That means nearly every pound of output in the economy has a pound of debt attached to it.

Debt isn’t just an abstract number. The larger it grows, the more taxpayers are forced to spend on interest rather than services.

💷 £52,000 Per Adult

Strip out children under 18, and Britain has 55.9 million adults. Against a debt pile of £2.91 trillion, that’s ≈ £52,000 per adult (18+).

That’s like handing every adult in the UK a second mortgage. Only this one isn’t paying for a house, or even for a long-term investment. It’s paying for day-to-day spending that we can’t afford.

This figure also masks the reality that taxpayers, not just adults, ultimately shoulder the cost. For a typical household, it’s tens of thousands of pounds in hidden liabilities.

📈 Why the Deficit is Growing

ONS data shows borrowing is climbing because spending is rising faster than receipts.

Spending up £7.8bn year-on-year:

Goods & services +£3.7bn — pay rises for public sector staff, and inflation making everything more expensive.

Debt interest +£1.9bn — driven by index-linked gilts, which alone added £2.6bn this month due to movements in RPI.

Social benefits +£1.1bn — uprated pensions and inflation-linked benefits driving higher welfare spending.

Receipts up, but not enough (+£4.3bn YoY):

Income Tax +£1.0bn

NICs +£2.6bn — largely thanks to April’s increase in employer National Insurance contributions.

VAT and Corporation Tax rose slightly.

The imbalance is stark: even with higher taxes and NI contributions, the government cannot keep up with its rising bills.

⚠️ Off Track Already

We are not even halfway through the financial year, but the numbers show the UK is already badly off course:

April–August 2025 borrowing: £83.8 billion.

That’s £16.2 billion more than last year, and

£11.4 billion higher than the OBR’s March forecast.

The government is spending faster than planned, with no credible route back to balance. Every missed target today means even harsher decisions tomorrow.

📈 Borrowing Costs at Historic Highs

Under Rachel Reeves, the cost of government borrowing has climbed to historic highs.

Ten-year gilt yields are now around 4.7% — compared with less than 1% in 2021.

Every pound of debt maturing has to be refinanced at rates five times higher than just a few years ago.

The result is billions more of taxpayers’ money swallowed by interest payments instead of frontline services.

This squeeze isn’t temporary. With debt levels nearing £3 trillion, even small increases in gilt yields result in huge extra costs.

🏦 A Debt Mountain That Drains Britain

The UK’s debt mountain doesn’t just sit quietly on the books — it demands payment every single month:

August interest bill: £8.4 billion.

Of this, £2.6 billion was simply an RPI “uplift” on index-linked gilts — meaning inflation is literally inflating the cost of our debt.

To put that in perspective:

The August interest bill alone could have paid the annual salary of around 236,000 NHS nurses (based on the ONS median of £35,584).

This is the trap: as debt rises, interest rises with it, swallowing more and more of the tax base. It’s money gone — with nothing to show for it.

🚨 The Bottom Line

Britain is piling on debt faster than forecast. Borrowing is surging, spending is outrunning income, and debt is now close to £3 trillion. That’s £52,000 for every adult in the UK — and climbing.

The longer this continues, the bigger the bill taxpayers will face — and the less room government will have to fund services, cut taxes, or invest in growth.

✍️ Thanks for reading Stat of the Nation. If you find these stats and insights useful, please share or subscribe to support my analysis.

I crunch the numbers so you don’t have to.

📲 Follow me here for more daily updates:

Mathematically we are fooked. Buy gold and/or bitcoin

So what amount of outgoings does uk send to foreign countries for aid and other assistance payments? How much could we redistribute if we could cut foreign aid amounts back to 0.5%?