Rachel Reeves’ Economic Strategy Is Failing — Today’s GDP Data Proves It

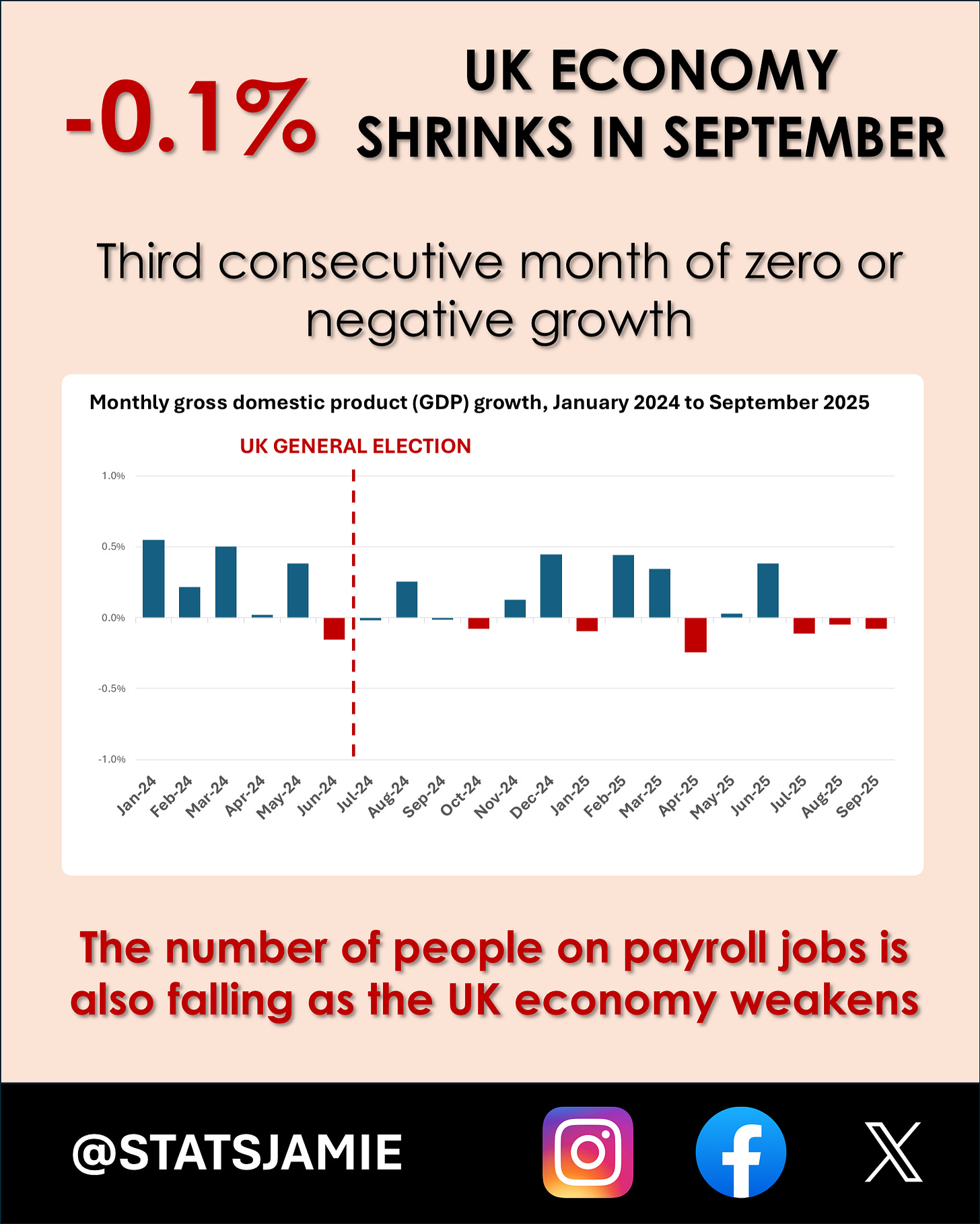

Three straight months of zero or negative growth expose a weakening economy under her watch.

September’s GDP figure — down 0.1% — confirms what the jobs data has been signalling for months: the economy is losing momentum, industry is stalling, and the private sector is being squeezed at the worst possible time.

This wasn’t a one-off. It’s the third month in a row of zero or negative growth. A clear trend, not a blip. And it’s happening directly under Labour’s watch.

📉 Three Months of Zero or Negative Growth

Since July, the UK hasn’t posted a single positive month of GDP. August was revised down to zero. July was negative. And now September has slipped into the red.

For a government insisting the economy has turned a corner, the numbers point the other way. Momentum has drained away, confidence is fading, and activity is increasingly fragile.

🏭 A Serious Industrial Downturn

The most alarming part of today’s release comes from the production sector, which fell 2% in September — the sharpest monthly drop since early 2021.

Manufacturing, mining, energy and water all declined. But the real collapse came from motor vehicles, where output plunged 28.6% in a single month — a fall so large it dragged the entire economy down on its own.

This is not a normal fluctuation; it is an industrial downturn. When manufacturing and transport equipment roll over this sharply, it sends shockwaves across supply chains, investment plans and regional economies.

The UK cannot grow if the industries that generate high-value jobs are shrinking.

📦 Quarter Three Confirms the Loss of Momentum

The ONS also confirmed that the economy grew just 0.1 per cent across the July to September period.

At first glance, that seems at odds with the monthly numbers — all three months were flat or falling. But quarterly GDP compares the average level of output in July, August and September with the average level from April to June. And although each month within Q3 weakened, the level of GDP was still slightly higher than it had been earlier in the year. That small difference is enough to leave the quarter just in positive territory.

But what matters is the direction. And direction is now clearly down.

🏛️ Public-Sector Activity Is Propping Up the Figures

The detailed services breakdown makes this even clearer. Across the entire services sector, output grew just 0.2 per cent over the quarter. But the strongest contribution came not from the private-sector engines of growth, but from government and other services, which rose 0.3 per cent.

By contrast:

Business services and finance — the backbone of private-sector demand — grew only 0.1 per cent.

Transport, storage and communication also grew just 0.1 per cent.

Distribution, hotels and restaurants moved up 0.2 per cent, but remain subdued.

In other words, the areas most closely linked to business confidence, investment and private-sector activity were barely growing at all. The sector with the strongest quarterly growth was the one dominated by government services.

This creates a worrying imbalance: the public sector is doing more of the heavy lifting at a time when the private economy is weakening underneath it.

Without the uplift from government and consumption-rich categories, services growth would have been close to zero.

That is not the foundation of a recovery — it is a warning sign that the UK is relying on state-driven activity while the private sector stalls.

👷♂️ The Jobs Market Confirms the Slowdown — Thirteen Months of Losses

If you want proof that the economy is weakening, look at the jobs market.

As I set out in Thirteen Months of Job Losses — Thanks to Labour’s Jobs Tax, unemployment has climbed to 5% — the highest since the Covid lockdowns — and payroll jobs are falling month after month. Since Labour took office, around 170,000 people have left the payroll, with 64,000 jobs lost in the past two months alone. Before the election, payrolls were rising. Now we’ve had 13 declines in 16 months.

The burden is hitting younger workers hardest, with around 220,000 losses among under-35s, and areas like London and Wales showing some of the steepest drops. Even Westminster has seen the largest proportional fall in the country.

This is exactly what happens when a government raises the cost of employing people. Labour’s so-called “jobs tax” has pushed firms to cut shifts and roles just as the wider economy has slowed. If you make hiring more expensive, employers hire fewer people — and that is now happening on the ground.

⚠️ What It All Means — and the Challenge Ahead in the Budget

The UK now enters a crucial few weeks before the autumn Budget with:

a shrinking economy

a weakening private sector

an industrial downturn

falling jobs

slowing services

and minimal growth in the last quarter

This is the context the Chancellor must now navigate.

The decisions taken in last year’s Budget are part of the problem:

higher taxes on employers

higher taxes on work

a tax burden now at a post-war high

no meaningful supply-side reforms

little relief for investment or hiring

These choices have stifled private-sector activity at the exact moment the economy was losing momentum.

That is why growth is flat. That is why hiring is falling. That is why confidence is slipping. And that is why the next Budget now matters urgently.

To turn the economy around, the Chancellor must:

reverse the pressure on employers

reduce the cost of hiring

support investment

rebuild business confidence

and shift the balance from public-sector-driven GDP back to private-sector growth

If she fails to do that, the UK is at real risk of sliding into a deeper slowdown as we enter 2026.

📣 Final Thought

These numbers tell a story no briefing line can hide: Britain is not turning a corner — it is stalling.

Industry is contracting. Business services are softening. Jobs are falling. Quarterly growth is barely positive. And the public sector is holding up what remains. The UK cannot grow on that foundation.

We need policies that reward work, encourage hiring, and support the businesses that generate real wealth. Without that, the numbers will keep drifting in the wrong direction — and families will feel the consequences in their jobs, wages and living standards.

✍️ Jamie Jenkins

Stats Jamie | Stats, Facts & Opinions

📢 Call to Action

If this helped cut through the noise, share it and subscribe free at statsjamie.co.uk — get the stats before the spin, straight to your inbox (no algorithms).

📚 If you found this useful, you might also want to read:

👉 Rachel Reeves Has Dug a £92 Billion Hole in the Public Finances — Since taking office, Rachel Reeves has borrowed £92 billion more than forecast, blowing a hole in Britain’s finances despite promising to “reduce the debt.”

📲 Follow me here for more daily updates:

I think we all know that Rachel and the Labour Party aren't going to do anything to make it better - she is going to put up taxes again and then continue to spaff money in all the wrong places. I heard the BBC telling us that the downturn in the motor industry was all due to Jaguar and its hacking issues. They will all just continue as they are - headless chickens running hysterically over a cliff whilst shouting that it's all fine, everything is fine.