High Borrowing, Falling Jobs, No Plan — Wales Shows Labour’s Collapse Is Coming

Borrowing stays sky-high, inflation is being nudged up by policy choices, jobs keep falling — and Wales is the warning of what 26 years of Labour rule produces.

This week’s data all point in the same direction. Borrowing remains dangerously high, policy choices are pushing costs up, jobs are falling, and the long-run consequences are already visible in Wales.

This isn’t a collection of bad headlines. It’s a single story, told from four different angles. Here’s how it all fits together.

🏦 Borrowing Is High — And Investment Is Being Cut

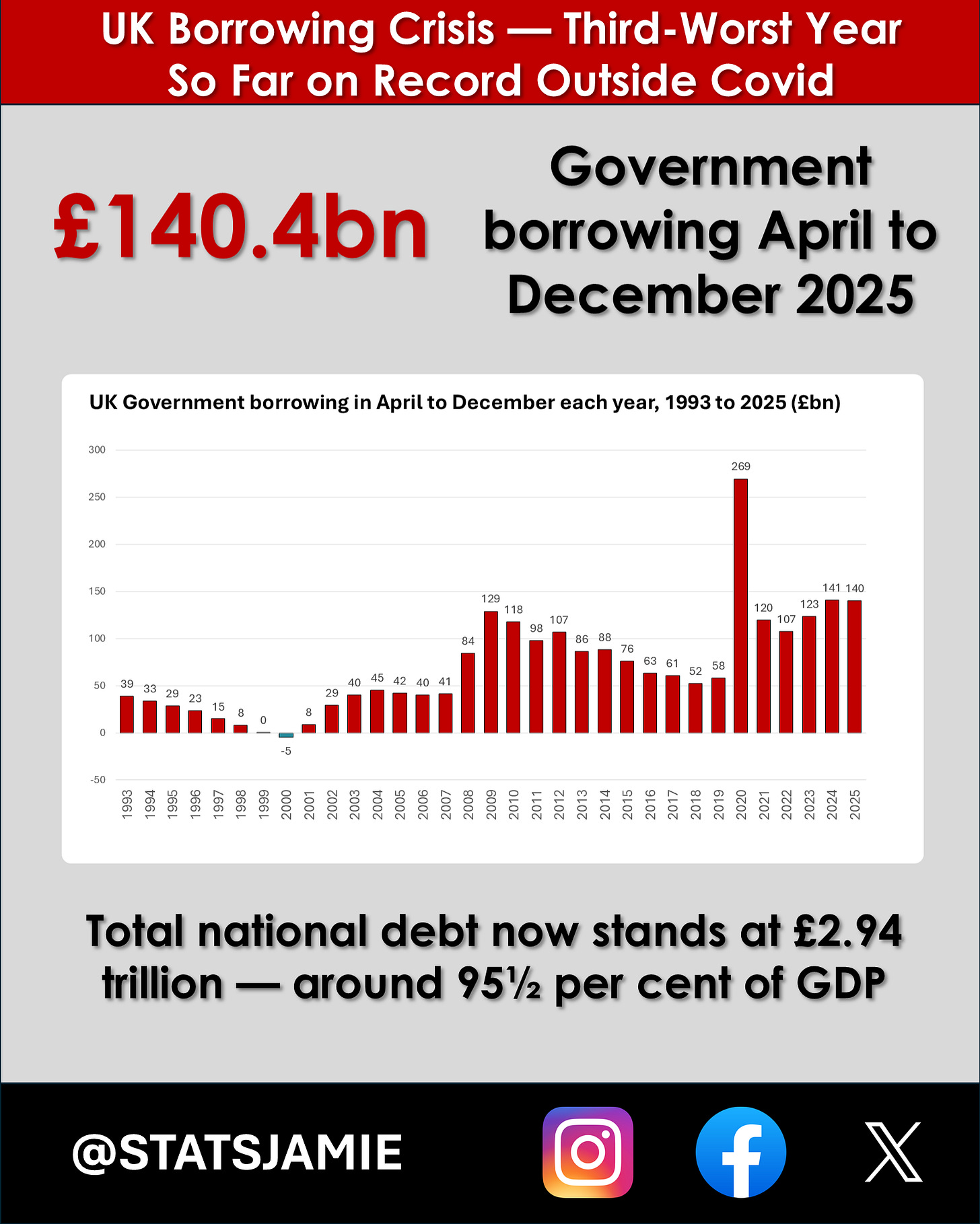

Government borrowing from April to December 2025 has now reached £140.4bn — the third-worst year on record outside Covid.

But zoom out to the full calendar year and the picture gets worse: in 2025, the UK borrowed £151.9bn.

And this is happening with the debt stock already stretched. National debt is around £2.94 trillion — roughly 95.5% of GDP.

That’s dangerously high because it leaves the country with very little margin for error:

When rates or inflation move, debt interest costs move with them

It reduces the headroom to respond to the next shock without even more borrowing

It makes the deficit more sensitive to market confidence and borrowing costs

And crucially, this isn’t because the state isn’t taking money in. Tax receipts are at record levels — now over £1 trillion a year.

So the problem isn’t revenue. The problem is spending. The big-ticket costs aren’t one-off projects — they’re the day-to-day cost of running the state and the welfare system:

Public sector pay and headcount are rising

Welfare spending is rising

Debt interest remains close to £100bn a year

And underneath the headline borrowing number sits an even bigger long-term problem: government investment is being cut.

Borrowing heavily can be justified if it builds future capacity — infrastructure, productivity, growth. Borrowing heavily while cutting investment leaves you with higher debt and weaker prospects.

We’re not borrowing to build. We’re borrowing to stand still.

📈 Inflation Isn’t an Accident — And It Feeds Borrowing

Inflation ticked higher again — with UK CPI now at 3.4%.

And part of that rise is policy-driven.

Recent tax rises, including changes to tobacco duty, fed directly into the inflation basket. That matters because inflation doesn’t just hit household bills — it feeds straight back into the public finances.

When inflation rises:

Index-linked gilts become more expensive to service

Benefits uprated by inflation automatically increase

Day-to-day public spending rises without a single new policy decision

So when ministers push inflation higher through tax choices, they aren’t just squeezing consumers — they’re baking higher borrowing into the system.

Now look at the international picture.

UK inflation at 3.4% is higher than Germany (around 2.0%) and higher than France (around 0.7%).

And yes, delusional people will tag me on social media, blaming Brexit.

But if that’s the explanation, it falls apart the moment you look outside Europe.

The UK is also running higher inflation than the United States (around 2.7%), and far higher than China (around 0.8%).

So this isn’t something you can shrug off as “global” or reduce to one political slogan.

The UK is making choices that are keeping inflation higher than peer economies — and we pay for it twice: at the checkout, and in the public finances.

👷 Jobs Are Falling — And That Hits the Public Finances Too

The labour market is now flashing red. There have been four consecutive months of falling payroll employment, with 217,000 fewer people in work since the election.

That matters for growth — but it also matters directly for borrowing.

Fewer jobs means:

Lower income tax and National Insurance receipts

Weaker consumer spending

Higher benefit spending

This is how fiscal positions deteriorate even without new policy announcements.

When ministers say the economy has “turned the corner”, the jobs data says something very different. This looks less like a recovery and more like the early stages of a slowdown feeding straight into the public finances.

🏴 Wales Shows Where This Ends — 26 Years of Labour Rule

Economic incompetence in Labour isn’t subtle — it was practically admitted again last week.

First Minister Eluned Morgan acknowledged that her own finance secretary — and former First Minister — Mark Drakeford had an “interest [that] has never been in the economy”, despite now overseeing Wales’ £25bn budget and tax regime.

That tells you everything about priorities.

And it wasn’t the first time Welsh Labour has said the quiet part out loud.

Back in 2019, a senior Welsh Labour minister admitted:

“For 20 years we’ve pretended we know what we’re doing on the economy — and the truth is we don’t really know what we’re doing.”

At the time, it was brushed off as a gaffe.

In 2026, it reads like a confession.

Because when you look at what’s happening now — in Westminster as well as Cardiff Bay — it’s hard to argue anything has changed. Borrowing is high, investment is being cut, policy choices are pushing up inflation, and jobs are falling. The same absence of strategy is on display.

After 26 years of Labour rule, Welsh Labour now looks politically finished:

Polling shows Labour losing its dominant position

Former Labour voters are walking away in large numbers

The party looks exhausted, defensive, and out of ideas

And this isn’t just a devolved sideshow.

A collapse of Welsh Labour would hit Keir Starmer’s authority, because Wales is where Labour has governed longest, with the least interruption — and with nowhere left to hide.

Wales isn’t an outlier. It’s the endgame.

✍️ Jamie Jenkins

Stats Jamie | Stats, Facts & Opinions

📢 Call to Action

If this helped cut through the noise, share it and subscribe free by entering your email in the box below and get the stats before the spin, straight to your inbox (no algorithms).

📚 If you found this useful, you might also want to read:

📲 Follow me here for more daily updates: