Another Month, Another £20 Billion – Labour’s Borrowing Spiral Continues

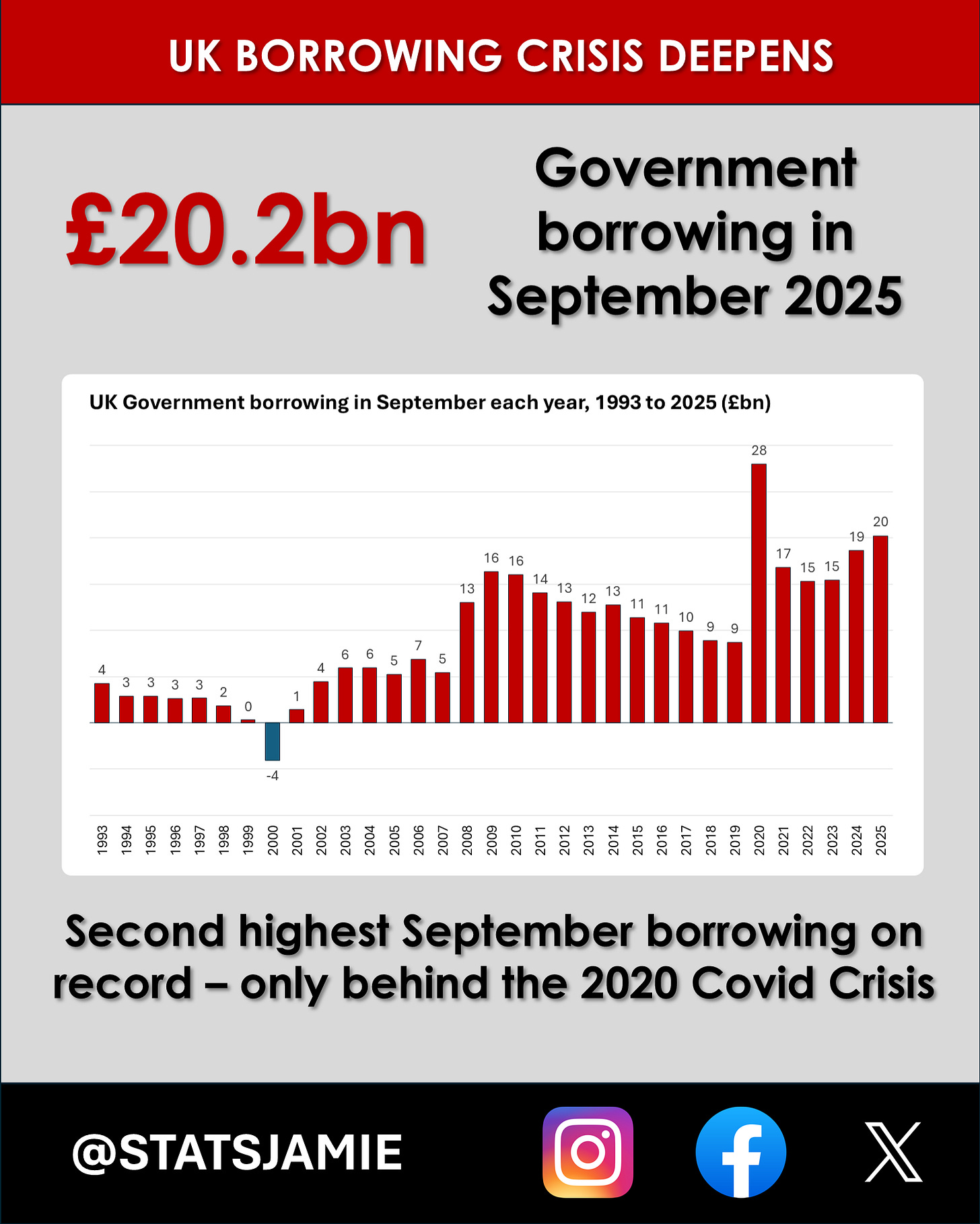

The UK borrowed £20.2 billion in September — the second-highest September on record — as national debt climbs towards £3 trillion.

The latest figures from the ONS paint a grim picture for Britain’s public finances. In September 2025, the UK government borrowed £20.2 billion — the second-highest September on record, topped only by the Covid lockdown year of 2020.

Total national debt has now reached £2.92 trillion — and at the current pace, Britain will crash through the £3 trillion debt barrier within the next year.

With the Budget due on 26 November, the numbers couldn’t be more damning: borrowing is rising, debt is climbing, and there’s no credible plan to bring spending under control.

1️⃣ Borrowing still climbing

Six months into the financial year, the UK has already borrowed around £100 billion — £7 billion more than forecast and £11 billion higher than the same point last year.

The £20.2 billion borrowed in September shows there’s been no post-Covid correction — only a deeper structural hole.

Debt interest, inflation, and public-sector pay are driving costs higher every month.

Reeves promised fiscal discipline. Instead, she’s delivered another borrowing binge.

2️⃣ Spending racing ahead of income

Government income rose, with higher receipts from Income Tax, VAT, and Corporation Tax.

But spending grew even faster — driven by:

Debt interest up £3.8 billion to £9.7 billion, including a £2.7 billion inflation-linked uplift on gilts.

Departmental costs up £2.6 billion, fuelled by pay settlements and inflation.

Benefits and pensions up £2 billion, as inflation and earnings ratchet drive uprating.

Even record tax receipts can’t keep pace with record spending — and the gap is widening.

3️⃣ Debt at record highs — and set to rise further

The UK’s national debt now stands at £2.92 trillion, the highest in peacetime history.

At this trajectory, the total will surpass £3 trillion within the next financial year — a milestone that once seemed unthinkable.

Debt interest alone is devouring billions every month, swallowing money that could otherwise fund schools, hospitals, or tax cuts.

And it’s being made worse by government policy that fuels inflation — from relentless spending to expensive green and welfare pledges — which in turn pushes up the cost of borrowing on index-linked gilts.

Reeves’ fiscal rule — to have debt falling by the end of the Parliament — already looks hopeless.

4️⃣ No plan to control spending — just higher taxes ahead

Rather than tackling waste or reforming the state, Reeves is expected to reach for the old solution: higher taxes.

But hiking taxes into a weak economy is the worst possible response — it chokes growth, discourages investment, and shrinks the very tax base needed to fix the problem.

Britain already faces record-high tax burdens, and squeezing families and businesses further will only slow the economy and make the debt problem worse.

Every month of delay piles billions more onto the debt mountain and leaves taxpayers carrying the burden.

Reeves and Starmer have lost control of the public finances — and their only answer is to take more from the people who keep the country running.

✍️ Jamie Jenkins

📚 If you found this useful, you might also want to read:

👉 The Generation Labour Forgot — 200,000 Young Workers Lost Since the Election — a deep dive into how government policy and higher job taxes have crushed opportunities for Britain’s young workers.

Stat of the Nation exists to cut through the spin and show the numbers as they are.

If you value clear, fact-driven analysis — please share this roundup with others. And hit subscribe below to get the stats first, every week.

📲 Follow me here for more daily updates:

The UK needs austerity: https://open.substack.com/pub/puzzlepolitics/p/the-uk-needs-more-not-less-austerity